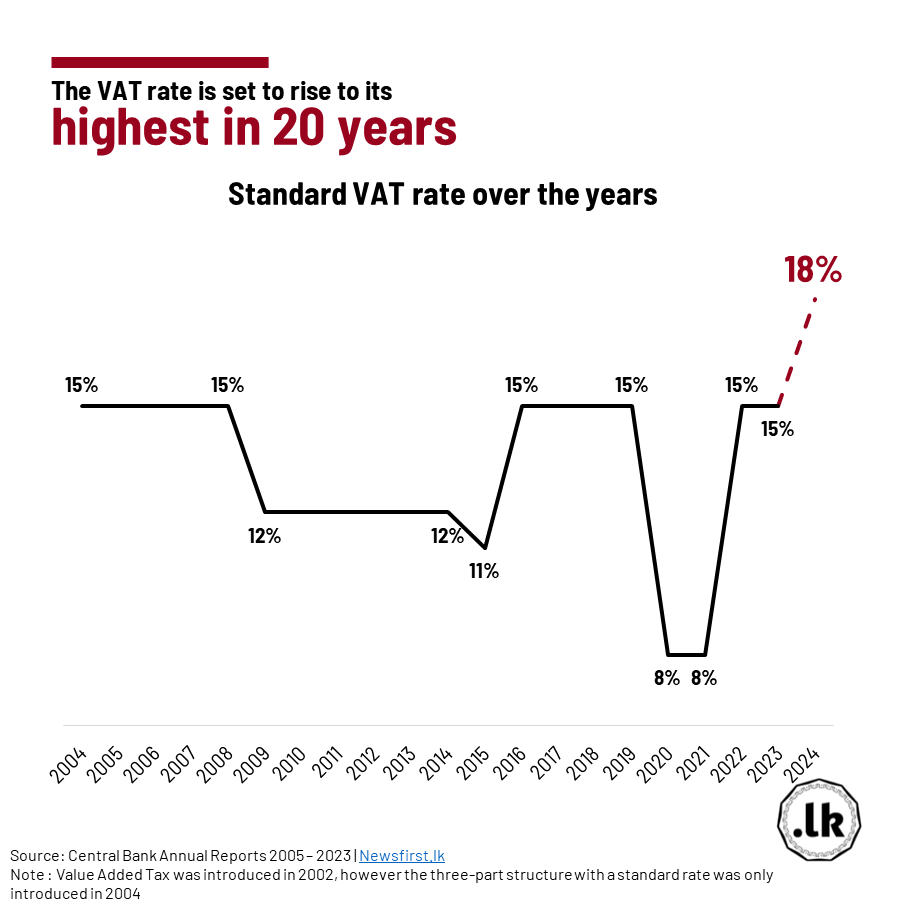

The Cabinet recently sanctioned an increase in the Value Added Tax (VAT) rate, is due to come into effect on January 1, 2024. This amendment will increase the rate from the present 15% to 18%, marking the highest level in two decades.

Initially introduced in 2002, the VAT comprised two tiers: a 10% rate applicable to certain goods and services, and a 20% rate for others. However, in 2004, these rates were unified to a 15% rate, which was officially adopted as the standard rate in 2005. Subsequently, the rate underwent several adjustments. It was reduced to 12% on January 1, 2009, and further decreased to 11% in 2015. Yet, it was raised again to 15% in 2016, before experiencing a significant decline to 8% in 2019 along with the various tax cuts announced in 2020. The VAT rate remained at 8% until 2021. In 2022, the rate underwent two changes: first to 12% in May, and then reverting to 15% in September. With the forthcoming amendment in 2024, the VAT rate is poised to reach a record high of 18%.

Post your comments or questions in the tab below.

If you would like to receive our monthly newsletter, post a comment saying 'RQNL', including your email address.