නිදහස් හා විවෘත ප්රවේශය

රාජ්ය මූල්ය දත්ත හා විශ්ලේෂණයන් සඳහා

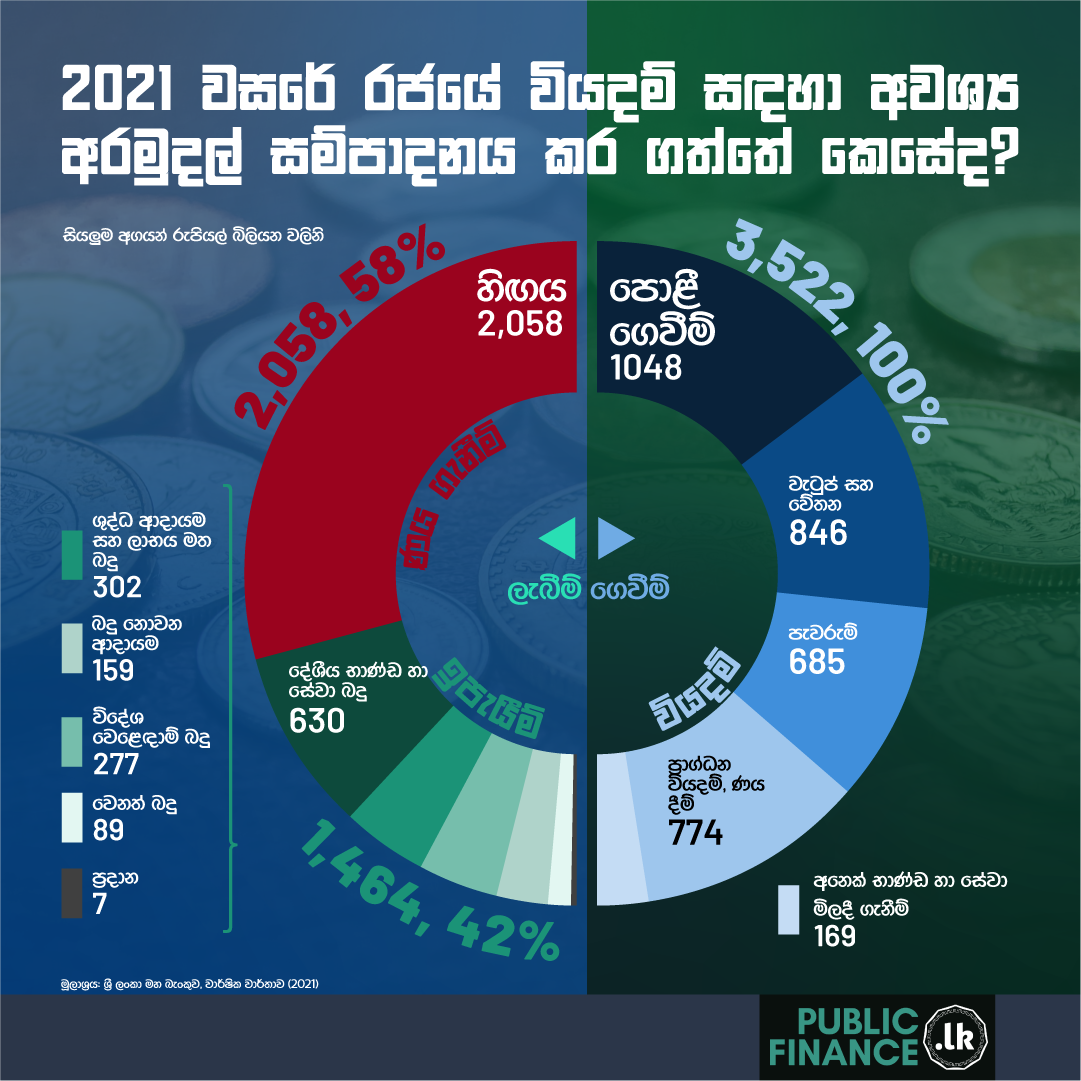

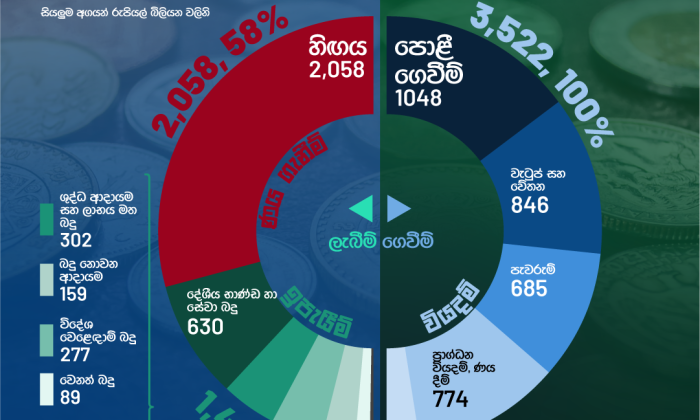

ග්රැෆික් සටහන රජයේ වියදම් සහ 2021 වසරේදී ඒ සඳහා අරමුදල් සම්පාදනය කර ගත් ආකාරය පිළිබඳව විස්තර සපයයි.