Public Finance Data and Analysis

Free and Open Access to

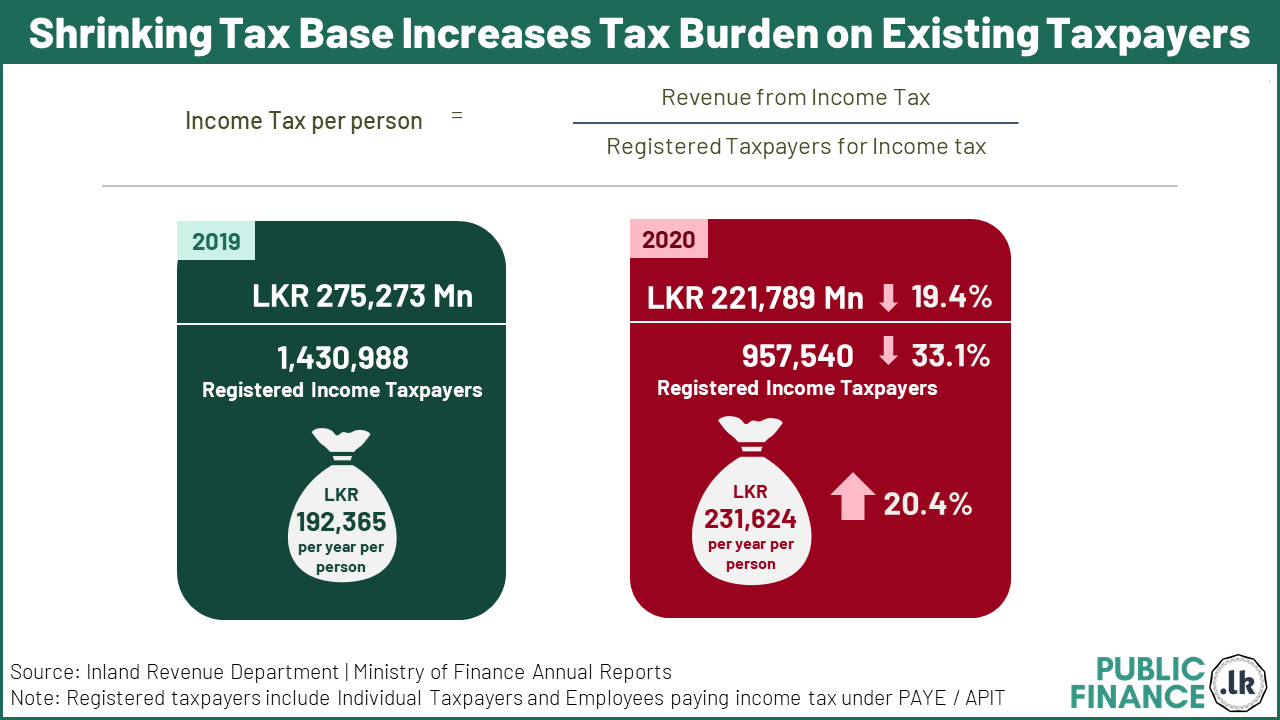

The income tax per person is calculated as the total government revenue from income tax (including PAYE) divided by the total registered taxpayers for income tax which includes Individual Tax Payers and Employees paying income tax under PAYE / APIT. The tax per person rose by 20% from LKR 192,365 in 2019 to LKR 231,624 in 2020 despite the tax policy changes to replace PAYE with APIT and the increase in the tax thresholds for income tax. This increase was mainly due to the fall in the registered tax base, by 33%* was greater than the fall in the total income tax revenue collected, which means that the few existing income taxpayers end up paying more than before.

For more on the tax base reduction click here