Strategic Development Project Act No. 14 of 2008.

The Board of Investment of Sri Lanka together with the Minister in charge of the subject of Investment can identify any proposed project as a “Strategic Development Project”.

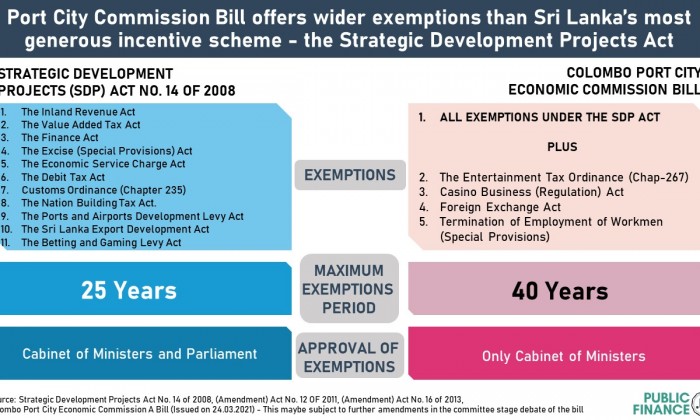

Strategic Development Projects can be given tax exemptions from any of the following acts mentioned in the Schedule of the Strategic Development Project Act No. 14 of 2008.

- The Inland Revenue Act, No. 10 of 2006

- The Value Added Tax Act, No. 14 of 2002

- The Finance Act, No. 14 of 2002

- The Finance Act, No. 5 of 2005

- The Excise (Special Provisions) Act, No. 13 of 1989

- The Economic Service Charge Act, No. 13 of 2006

- The Debit Tax Act, No. 16 of 2002

- Customs Ordinance (Chapter 235)

- The Nation Building Tax Act, No. 9 of 2009.

- The Ports and Airports Development Levy Act, No. 18 of 2011.

- The Sri Lanka Export Development Act, No. 40 of 1979.

- The Betting and Gaming Levy Act. No. 40 of 1988.”

These exemptions can be given for a maximum of period of 25 years.

The process for the approval of the exemptions under the Strategic Development Project Act is as follows:

- Minister’s Notification: The Minister in charge of the subject of Investment shall by Notification published in the Gazette publish the relevant information relating to each proposed project and the exemptions to be granted in respect of the same (Section 3 (2)).

- Approval of Cabinet Ministers: The Minister in charge of the subject of Investment, shall in consultation with the Minister in charge of the subject of Finance take such steps as are necessary to inform the Cabinet of Ministers of— (a) the rationale for considering such project as a Strategic Development Project ; and (b) the period of exemption proposed to be granted, and obtain the approval of the Cabinet of Ministers for the identification of the project as a Strategic Development Project and for the granting of exemptions to such Project in terms of section 2 (Section 3 (3)).

- Publish an order in the Gazette

The Minister in charge of the subject of Investment shall, within six weeks from the date on which the approval of the Cabinet is granted, by Order published in the Gazette, specify the name of the Strategic Development Project, the date of commencement of such Project and the date on which the exemptions from the enactments specified in the Schedule hereto, granted in terms of section 2 will become operative and the date from which the same shall cease to be operative (Section 3 (4)).

- Approval by Parliament

Every Order made under subsection (4) of section 3 shall, (a) become operative immediately upon approval by Resolution of Parliament; and (b) if not approved by Parliament, be deemed to be rescinded with effect from the date of such Resolution, without prejudice to anything previously done thereunder (Section 4 (2)).

Colombo Port City Economic Commission Bill

The Commission in consultation with the President or in the event that the subject of Colombo Port City is assigned to a Minister, in consultation with such Minister, may identify businesses, which may be designated as “Businesses of Strategic Importance” (Section 52 (2)).

Exemptions or incentives can be provided from all or any of the enactments set out in Schedule II. (Section 52 (3)). Enactments in Schedule II are as follows:

- The Inland Revenue Act, No 24 of 2017

- The Value Added Tax Act, No. 14 of 2002

- The Finance Act, No. 14 of 2002

- The Finance Act, No. 5 of 2005

- The Excise (Special Provisions) Act, No. 13 of 1989

- The Debit Tax Act, No. 16 of 2002

- Customs Ordinance (Chapter 235)

- The Ports and Airports Development Levy Act, No. 18 of 2011.

- The Sri Lanka Export Development Act, No. 40 of 1979.

- The Betting and Gaming Levy Act, No. 40 of 1988

- Termination of Employment of Workmen (Special Provisions), No 45 of 1971

- The Entertainment Tax Ordinance (Chap-267)

- Foreign Exchange Act, No 12 of 2017

- Casino Business (Regulation) Act, No 17 of 2010

These exemptions can be given for a maximum of period of 25 years.

The process for the approval of the exemptions under the Colombo Port City Economic Commission Bill is as follows:

- Recommendations from the Commission

Upon a business being so identified as a Business of Strategic Importance, the Commission shall make recommendations to the President or in the event that the subject of the Colombo Port City is assigned to a Minister relating to the designation of such business as a Business of Strategic Importance and the grant of any exemptions or incentives in terms of section 52 of this Act (Section 53 (1)).

- Approval of Cabinet Ministers

The President or in the event that the subject of the Colombo Port City is assigned to a Minister, such Minister, may, having considered such recommendations, and having regard to the national interest or in the interest of the advancement of the national economy, in consultation with the Minister assigned the subject of Finance, take such steps as are necessary to inform the Cabinet of Ministers. (Section 53 (2)).

- Publish an order in the Gazette

(3) Within two weeks from the date on which the Cabinet of Ministers approves the designation of a business as a Business of Strategic Importance and the granting of the exemptions or incentives so approved, the President or in the event that the subject of the Colombo Port City is assigned to a Minister, such Minister shall, by Order published in the Gazette. (Section 53 (3)).

- Inform the Parliament (No approval required)

Upon the expiry of thirty days from the date of such Order published in the Gazette under subsection (3), such Order along with a written confirmation issued under the hand of the Commission confirming that the exemptions or incentives set out in the notification are compliant with the provisions in terms of Part IX of this Act, shall be placed before Parliament for information (Section 53 (4)).

Note: The Colombo Port City Economic Commission Bill used in this analysis is based on the draft version of the bill issued on 24.03.2021. This could be subject to further amendments in the committee stage debate of the bill.

Further, the Supreme Court Determination on the bill, S.C.S.D. Nos. 04/2021,05/2021,07/2021 to 23/2021 also raised a concern on section 53 of the Act.

Update on 01 June 2021: The Colombo Port City Economic Commission Act, No. 11 of 2021 (the final Act enacted the Parliament) only provides for changes in terminology as recommended in the Supreme Court Determination of the Bill. That is, that words "the specific enactments from those listed in" be deleted and and substituted with the words "the specific exemptions from those enactments listed in” in clause 53 (2) b and clause 53 (3) (b) of the Bill. Therefore, the comparison mentioned in the info-graphic continues to be reflected in the final Act.

Sources

1. Strategic Development Projects Act No. 14 of 2008

2. Strategic Development Projects (Amendment) Act No. 12 OF 2011

3. Strategic Development Projects (Amendment) Act No. 16 of 2013

4. Colombo Port City Economic Commission A Bill (Issued on 24.03.2021)