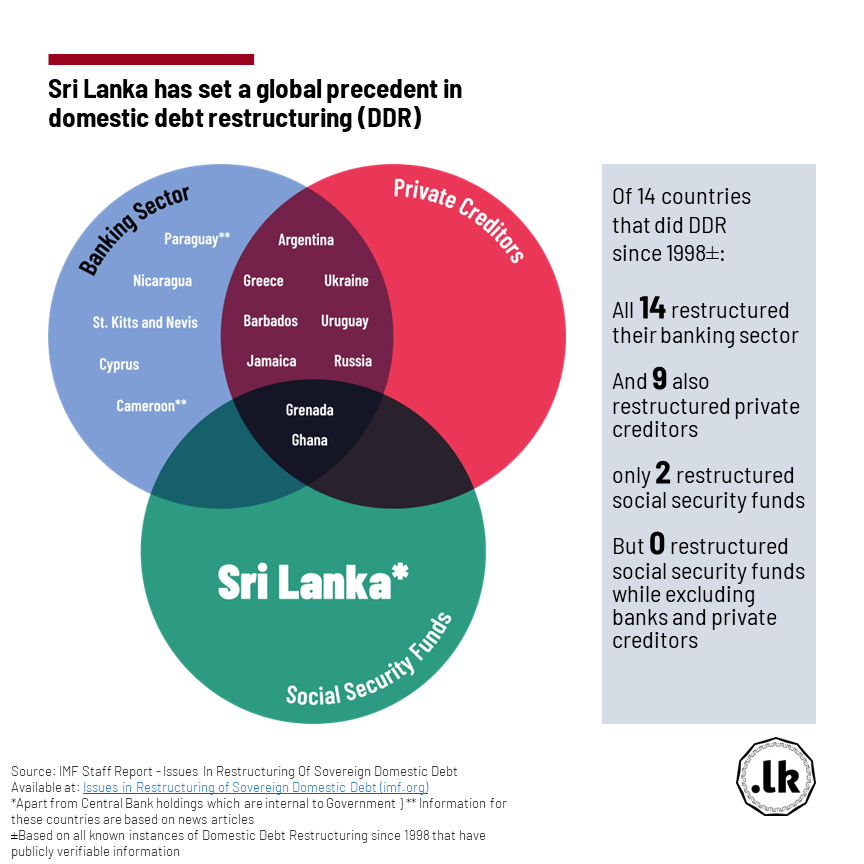

Sri Lanka's approach to Domestic Debt Restructuring (DDR) stands out in its specificity and methodology. Notably, the strategy is centred on restructuring superannuation funds and Central Bank Holdings. According to an IMF staff report titled “Issues in Restructuring of Sovereign Domestic Debt” that detailed all 14 DDR episodes from 1998 onwards*, Sri Lanka is the only country that has adopted such a focused approach.

The table and the Venn diagram below illustrate a clear deviation from the norm. While all 14 DDR episodes involved the restructuring of the banking sector, and 64% restructured private holdings, none exclusively targeted their pension funds. Only Grenada and Ghana included public pension funds in their restructuring, but these funds were among several other targets.

|

Country |

Timeline |

Parties targeted for Domestic Debt Restructuring |

|

Grenada |

(2013-2015) - DDR+EDR |

|

|

Ghana |

(2022- Present) - DDR +EDR |

|

|

Greece |

(2011- 2012) - EDR + DDR |

|

|

Barbados |

(2018 -2019) - EDR + DDR |

|

|

Jamaica |

(2010) - DDR |

|

|

Russia |

(1998–2000) - DDR + EDR |

|

|

Ukraine |

(1998–2000) - DDR +EDR |

|

|

Uruguay |

(2003) - DDR +EDR |

|

|

Argentina |

(2018-2023) - EDR+DRR |

|

|

Nicaragua |

(2008) - DDR |

|

|

St. Kitts and Nevis |

(2011–2012) - EDR +DDR |

|

|

Cyprus |

(2013) - DDR |

|

|

Cameroon |

(2004 – 2005) - DDR |

|

|

Paraguay |

(2002 – 2003) - DDR |

Conversely, Sri Lanka's strategy excludes private bondholders, banks, and other financial institutions that remain unaffected by the restructuring process. This approach diverges from the International Sovereign Bonds (ISB) on restructuring, which typically encompasses banks and private holders within its purview.

Source: IMF Staff Report - Issues In Restructuring Of Sovereign Domestic Debt | available at: Issues in Restructuring of Sovereign Domestic Debt (imf.org)

*Note: As the IMF staff report did not provide information on DDR for Cameroon and Paraguay, publicfinance.lk relied on available news sources to assess the parameters of DDR for the above-mentioned countries

**Note: Data for Ghana was sourced from the Ministry of Finance of Ghana's official documents. While the April 2023 investor presentation excluded pension funds, the Ministry's press release on 31st July 2023 confirmed their inclusion in the debt restructuring framework.