92 Octane petrol

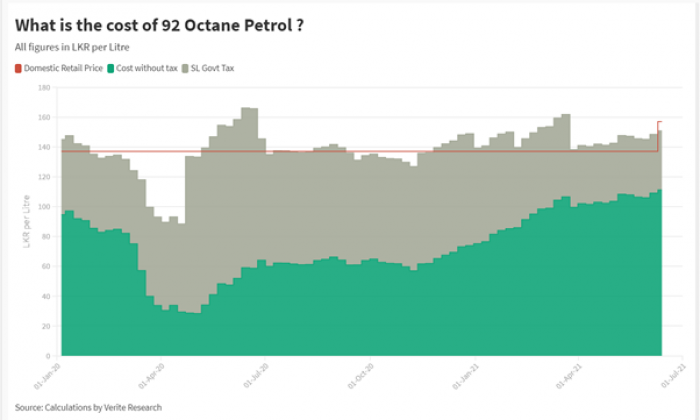

The Interactive chart below compares the cost (includes the Landed cost of Singapore Platts Petrol, Processing cost and Administrative cost), taxes (includes Customs Duty, Excise and PAL) and the retail price of selling one unit of 92 Octane petrol. The cost calculated is an estimate based on the details released on the Fuel Price Formula by the Ministry of Finance to the public.

For example, on 13 June 2021, the cost of a litre of 92 Octane Petrol was LKR 111 ( includes the Landed cost of Singapore Platts Petrol, Processing cost and Administrative cost). However, a total tax of LKR 40 was charged by the government of Sri Lanka on a litre of 92 Octane Petrol. This raised the total cost of selling one litre of 92 Octane Petrol for Ceylon Petroleum Corporation (CPC) to LKR 151, while the retail selling price was LKR 157.

The tax charged has varied with the cost of the fuel over time. For instance, at the end of April 2020 when the cost was at its lowest at LKR 28, the total tax on a litre of 92 Octane Petrol was LKR 105. As the cost began to increase due to a rise in global prices, the tax charged has fallen over time to reach LKR 40 in June 2021.

It is important to specifically note that during 2020 and 2021, the price charged on 92 Octane Petrol had been higher than its cost, excluding government taxes. Therefore, at the new prices (effective from 11 June 2021), the government is still able to make a gain of LKR 40 in tax revenue. That is in addition to LKR 6 margin gained by CPC in selling 92 Octane Petrol.

Assuming the government did not change the tax policy in 2020 and 2021 — that is if the Fuel Price Formula introduced in May 2018 was applied to this, with taxes charged being held constant at the tax rates as at end 2019— the price of 92 Octane Petrol would be as follows;

.Auto Diesel

The Interactive chart below compares the cost (includes the Landed cost of Singapore Platts Diesel, Processing cost and Administrative cost), taxes (includes Customs Duty, Excise and PAL) and the retail price of selling one unit of Auto Diesel.

For example, on 13 June 2021, the cost of a litre of Auto Diesel was LKR 106 per litre. A total tax of LKR 13 was charged on a litre of Auto Diesel. This raised the total cost of selling one litre of Auto Diesel for CPC to LKR 119. However, the retail selling price was only LKR 111. Therefore, CPC makes a loss of LKR 8 per litre of auto diesel sold.

Yet, the government still gains LKR 13 as taxes from the sale of Auto Diesel. Therefore, the net gain to government is LKR 5 per litre on Auto Diesel.

Assuming the government did not change the tax policy in 2020 and 2021 — that is if the Fuel Price Formula introduced in May 2018 was applied to this, with taxes charged being held constant at the tax rates as at end 2019— the price of Auto Diesel would be as follows;

Note: This calculation is only an estimate based on the details released on the Fuel Price Formula by the Ministry of Finance to the public. The estimate was obtained by reverse engineering the aggregate details and is subject to a 3% margin of error.

Details on the data and assumptions used for the above calculations are given in the table below;

|

Variable |

Description |

Assumption |

|

V 1 |

Landed Cost (LKR/Litre) |

|

|

Includes |

||

|

Weighted average premium per barrel and loss due to the evaporation |

Assumed to be |

|

|

Singapore Price per Barrel in USD |

Singapore petrol and diesel prices released by the CBSL on subscription basis |

|

|

Exchange Rate (USD/LKR) |

Indicative US Dollar SPOT Exchange Rate released by CBSL |

|

|

No of Litres per barrel |

158.9 |

|

|

V 2 |

Processing Cost (LKR/Litre) |

Assumed to be |

|

V 3 |

Adminstrative Cost (LKR/Litre) |

Assumed to be 4% of the landed cost |

|

V 4 |

Taxation (LKR/Litre) |

Includes Customs Import Duty, Excise Duty, Ports and Airports Development Levy(PAL) and Nation Building Tax (now abolished) |